How Much Does It Cost to Rent a Jumping Castle

8 Places Where It's Better to Rent Than Buy

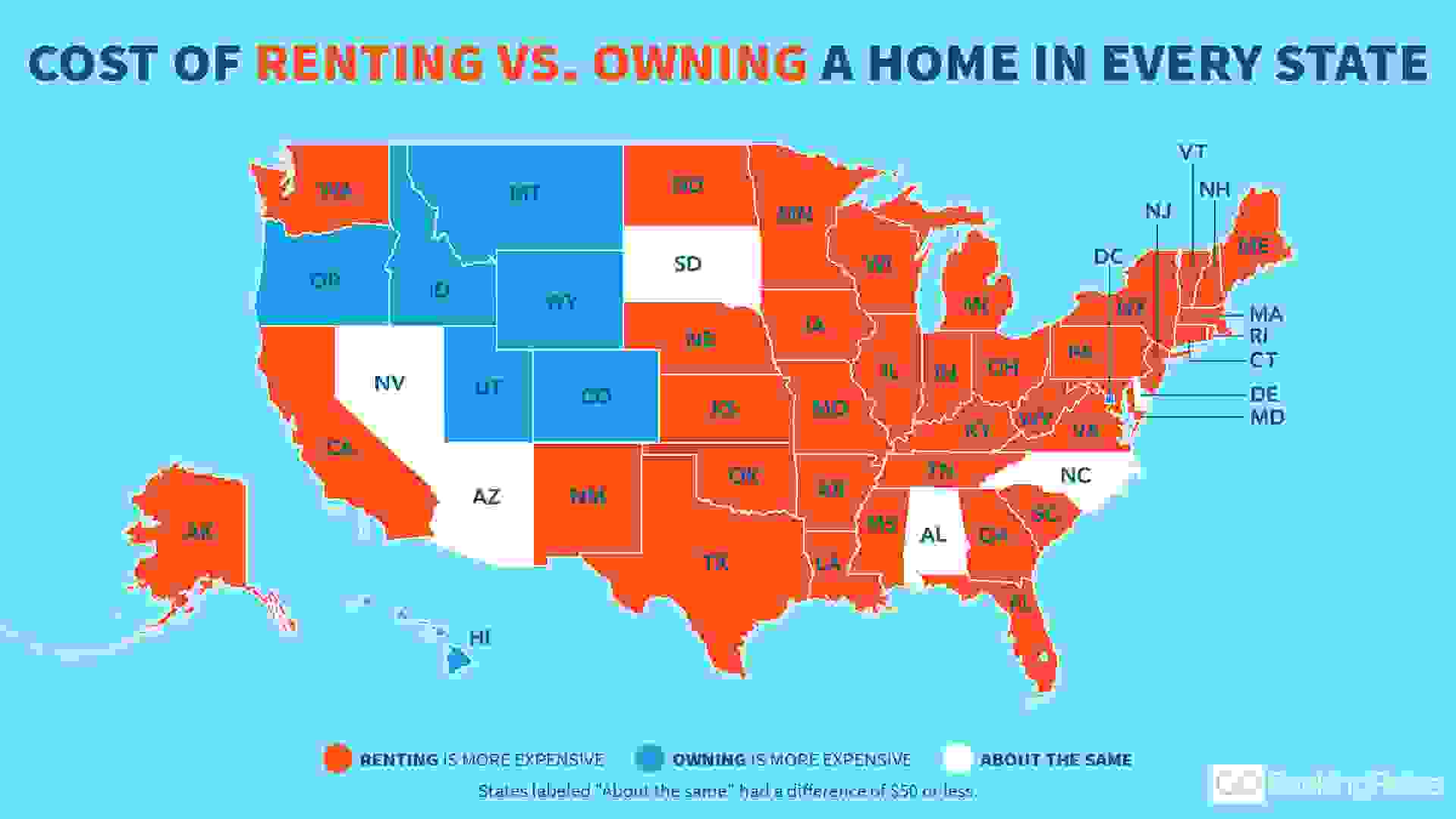

Buying a home might not always be the best financial strategy. In fact, in a few states, you'll actually spend less money if you opt to rent a place to live. Here are the states where it's cheaper to rent a home than buy.

Buying vs. Renting a Home in Colorado

Monthly rent in Colorado: $1,900

Monthly mortgage in Colorado: $1,991

Should you rent or buy: Rent

Although Colorado has the eighth-highest rent in the U.S., it's still cheaper to rent than to own there — but only $91 cheaper. When deciding between buying versus renting in Colorado, take other factors into consideration outside of wanting to save money.

Buying vs. Renting a Home in Washington, D.C.

Monthly rent in Washington, D.C.: $2,600

Monthly mortgage in Washington, D.C.: $2,760

Should you rent or buy: Rent

Washington, D.C., has the third-highest rent in the U.S., but it's still cheaper to rent there than to buy. With the second-highest monthly mortgage payments, renters in the capital city save $160 a month compared with homeowners. Plus, Washington, D.C., is among the states where homes values have increased the least.

Buying vs. Renting a Home in Hawaii

Monthly rent in Hawaii: $2,300

Monthly mortgage in Hawaii: $2,839

Should you rent or buy: Rent

Hawaii has the most expensive average mortgage in the U.S. So although the island state also has the fourth-highest rent, renters still save an average of $539 a month compared with homeowners. In a recent list, Honolulu was the second-most expensive premium travel destination to retire.

Buying vs. Renting a Home in Idaho

Monthly rent in Idaho: $1,290

Monthly mortgage in Idaho: $1,428

Should you rent or buy: Rent

Renters save $138 each month — or $1,656 per year — compared with homeowners in Idaho, where the median home list price is $295,000. Mortgage rates in Idaho are near the median mortgage rates for the country, at 4.42 percent.

Buying vs. Renting a Home in Montana

- Monthly rent in Montana: $1,200

- Monthly mortgage in Montana: $1,525

- Should you rent or buy: Rent

Montana is one of only 10 places in the U.S. where it's more expensive to buy than to rent. Home prices in the state have risen well above pre-recession levels, the Billings Gazette reported. With high monthly mortgages and the ninth-lowest average rent in the country, renters in Montana save an average of $325 a month compared with homeowners.

Read the Latest News: The Housing Crisis Is Officially Over

Buying vs. Renting a Home in Oregon

Monthly rent in Oregon: $1,725

Monthly mortgage in Oregon: $1,793

Should you rent or buy: Rent

There's only a $68 difference between mortgage payments and rent payments in Oregon. The state has the seventh-highest average monthly mortgage cost of all the states, so it does cost slightly more to buy. One perk of living in Oregon: It's one of six states that don't charge sales tax.

Buying vs. Renting a Home in Utah

Monthly rent in Utah: $1,495

Monthly mortgage in Utah: $1,685

Should you rent or buy: Rent

It's expensive to own a home in Utah: The state has the ninth-most expensive monthly mortgage payments in the country, which is bad news for working-class residents. And, it's one of the least affordable states for millennials to buy a home.

"Housing prices continue to rise far beyond the reach of low-income wage earners," Utah Housing Coalition Executive Director Tara Rollins told the Deseret News. On average, renters save $190 a month.

Buying vs. Renting a Home in Wyoming

Monthly rent in Wyoming: $1,025

Monthly mortgage in Wyoming: $1,200

Should you rent or buy: Rent

Wyoming is tied with Oklahoma for the third-cheapest average rent in the U.S. Renters save an average of $175 per month — or $2,100 a year — compared with average mortgage holders.

7 States Where Renting and Buying Are About the Same

In some parts of the country, the difference in cost of renting versus buying a home is negligible. In the following seven states, the difference in renting versus buying is less than $50 per month.

Plan Ahead: 7 Hidden Costs of Renting an Apartment

Buying vs. Renting a Home in Alabama

Monthly rent in Alabama: $1,000

Monthly mortgage in Alabama: $986

Should you rent or buy: Either

The cost difference between renting versus buying in Alabama is only $14, so deciding which housing option is best for you shouldn't be based on finances. Both options are affordable in Alabama, which has the second-lowest average rent prices of all the states. But homes are less affordable in the state's 36564 ZIP code — it's the most expensive ZIP code in the state, a separate GOBankingRates study found.

Buying vs. Renting a Home in Arizona

Monthly rent in Arizona: $1,405

Monthly mortgage in Arizona: $1,356

Should you rent or buy: Either

The cost difference between buying and renting in Arizona is only $49 — even less than in 2017, when the difference was $53. People looking to buy a home in Arizona should consider the city of Gilbert, which is the best city in the state to buy a home, a separate GOBankingRates study found.

Buying vs. Renting a Home in Delaware

Monthly rent in Delaware: $1,400

Monthly mortgage in Delaware: $1,372

Should you rent or buy: Either

It's only $28 cheaper to buy than to rent in Delaware, where the median list price is $281,900. In 2017, the cost difference was $96. This change is indicative of the state's increasing home prices: Home prices in Delaware are growing faster in 2018 than any state but Oregon, Delaware Online reported.

What to Look For: Best Mortgage Rates

Buying vs. Renting a Home in Nevada

Monthly rent in Nevada: $1,430

Monthly mortgage in Nevada: $1,461

Should you rent or buy: Either

It's technically cheaper to rent than to own in Nevada, but the cost difference is only $31 a month, on average. The cost difference between the two options has been shrinking: In 2017, it was $80 cheaper to rent. Whether you rent or buy, you can enjoy 0 percent income tax: A separate GOBankingRates study found it's one of the states where your take-home pay from a $100,000 salary is the largest.

Buying vs. Renting a Home in North Carolina

Monthly rent in North Carolina: $1,300

Monthly mortgage in North Carolina: $1,264

Should you rent or buy: Either

It costs $36 less to buy than to rent in North Carolina. And although the cost difference is small, it's worth noting that in 2017, it actually cost more to buy than to rent in the Southern state.

North Carolina is home to two of the highest-growth real estate markets of 2018 — Raleigh and Charlotte — according to Roofstock.

Buying vs. Renting a Home in South Dakota

Monthly rent in South Dakota: $1,100

Monthly mortgage in South Dakota: $1,130

Should you rent or buy: Either

South Dakota has one of the top 10 most affordable average rent prices of all the states, but it only costs $30 more a month to own a home. Bonus: South Dakota is one of seven states with no income tax.

37 States Where It's Better to Buy

For the majority of states, it's still a smart decision to buy a home rather than rent — if you can afford it. Check out the 37 states where you'll spend less money on a monthly mortgage than you will on a month's rent.

Buying vs. Renting a Home in Alaska

Monthly rent in Alaska: $1,625

Monthly mortgage in Alaska: $1,401

Should you rent or buy: Buy

It's $224 cheaper each month to buy than to rent in Alaska, but the cost difference between the two has been shrinking. In 2017, it was $373 cheaper to buy; over the last year, rent has decreased while mortgage costs have increased. Although it's better overall to buy in Alaska, the state has the highest average mortgage rate in the country: 4.56 percent. You'll save on taxes, though: It's one of the seven states with no income tax, and it has no sales tax either.

See: This Is the Credit Score You Need to Buy a House

Buying vs. Renting a Home in Arkansas

Monthly rent in Arkansas: $1,095

Monthly mortgage in Arkansas: $852

Should you rent or buy: Buy

Arkansas has the fifth-cheapest average rent of all the states, but the third-cheapest monthly mortgage payments. In this state, homeowners get the better deal. On average, mortgage payments are $243 less than rent costs each month. Plus, it's one of the top states for getting the most amount of property for your money, according to a separate GOBankingRates study.

Buying vs. Renting a Home in California

Monthly rent in California: $2,700

Monthly mortgage in California: $2,475

Should you rent or buy: Buy

Even though California has the third-highest monthly mortgage costs in the U.S., rent is even more expensive — especially in San Francisco, San Jose, Los Angeles, Oakland and San Diego, all of which are among the top 10 most expensive cities for median rent price of a one-bedroom, according to the June 2018 Zumper National Rent Report. With the second-highest monthly rent in the U.S., homeowners in California can save about $225 each month. Those that do opt to buy a home can benefit from California's low average mortgage rate: At 4.36 percent, it's the lowest in the country.

Check Out: 13 Ways California Real Estate Differs From Every Other State

Buying vs. Renting a Home in Connecticut

Monthly rent in Connecticut: $1,800

Monthly mortgage in Connecticut: $1,568

Should you rent or buy: Buy

Connecticut has the 10th most expensive average rent costs and the 10th most expensive average mortgage payments of all the states. But ultimately, buying is a better financial choice in the Northeastern state: Homeowners save $232 each month — or $2,784 a year — compared with renters.

Buying vs. Renting a Home in Florida

Monthly rent in Florida: $1,800

Monthly mortgage in Florida: $1,396

Should you rent or buy: Buy

Florida is tied with Connecticut for the 10th-highest average monthly rent in the U.S. On average, homeowners in the state save $404 on housing costs compared with renters. The state also has the lowest average mortgage rate at 4.36 percent. However, Florida is the state with the least affordable homeowners insurance, a separate GOBankingRates study found.

Buying vs. Renting a Home in Georgia

Monthly rent in Georgia: $1,380

Monthly mortgage in Georgia: $1,221

Should you rent or buy: Buy

It costs an average of $159 a month more to rent than to buy in Georgia. The difference in costs increased from 2017 due to rising rent prices. Because homes are still relatively affordable in Georgia, it's a good place to buy investment properties, Forbes reported.

Buying vs. Renting a Home in Illinois

Monthly rent in Illinois: $1,600

Monthly mortgage in Illinois: $1,129

Should you rent or buy: Buy

The average cost difference between buying and renting in Illinois is $471 a month. The difference has increased since 2017, when it was $363 cheaper to buy. If you decide to live in Illinois, you can narrow down your exact home location by deciding which Chicago suburb is right for you.

Buying vs. Renting a Home in Indiana

Monthly rent in Indiana: $1,100

Monthly mortgage in Indiana: $897

Should you rent or buy: Buy

Both rent and mortgage payments are the sixth-lowest in the country in Indiana — but it's still less expensive to buy a home in the state. Monthly mortgage payments are typically $203 less than monthly rent. Home prices are on the rise, however, according to the Indiana Association of Realtors. The median sale price for homes increased 8 percent from April 2017 to April 2018.

Buying vs. Renting a Home in Iowa

Monthly rent in Iowa: $1,089

Monthly mortgage in Iowa: $895

Should you rent or buy: Buy

Although Iowa has the fourth-lowest average rent of all the states, it's still cheaper to own a home there. The state has the fifth-lowest average monthly mortgage, and it's $195 less than the average monthly rent. But housing is scarce in the state, especially in the rural southwest, which is currently in the middle of a housing crisis, the Des Moines Register reported. So even if you want to buy a house in Iowa, you might not be able to.

Buying vs. Renting a Home in Kansas

Monthly rent in Kansas: $1,100

Monthly mortgage in Kansas: $923

Should you rent or buy: Buy

Homeowners typically spend $177 less per month than renters, even though Kansas has the sixth-cheapest rent of all the states. The state also has the 10th-lowest average monthly mortgage payments in the U.S. Affordable homes could be one reason housing has become scarce in the state, particularly in Kansas City, the city's ABC affiliate KMBC reported. Experts told the station that prospective buyers should be prepared to make an immediate offer to secure their dream home.

Learn: Advantages and Disadvantages of a Fixed-Rate Mortgage

Buying vs. Renting a Home in Kentucky

Monthly rent in Kentucky: $1,150

Monthly mortgage in Kentucky: $900

Should you rent or buy: Buy

Rent is relatively affordable in Kentucky — it's the eighth-lowest of all the states — but homeowners save an average of $250 per month on housing costs thanks to its even more affordable homes. Kentucky is tied with Ohio for the eighth-lowest average monthly mortgage payments.

Buying vs. Renting a Home in Louisiana

Monthly rent in Louisiana: $1,275

Monthly mortgage in Louisiana: $1,034

Should you rent or buy: Buy

Louisiana has the 10th-lowest average rent of all the states, but homeowners still save $241 each month compared with renters there on average.

Buying vs. Renting a Home in Maine

Monthly rent in Maine: $1,850

Monthly mortgage in Maine: $1,175

Should you rent or buy: Buy

The average monthly mortgage is $675 less than the average monthly rent in Maine. The Northeastern state has the ninth-highest average rent in the country, so buyers can save $8,100 over the course of a year.

Buying vs. Renting a Home in Maryland

Monthly rent in Maryland: $1,700

Monthly mortgage in Maryland: $1,515

Should you rent or buy: Buy

Homeowners save an average of $185 a month compared with renters in Maryland, where the median home list price is $315,000. Maryland is also No. 1 among states with the richest retirees.

Buying vs. Renting a Home in Massachusetts

Monthly rent in Massachusetts: $2,700

Monthly mortgage in Massachusetts: $2,114

Should you rent or buy: Buy

Massachusetts is tied with California for the second-highest rent costs in the U.S., so it's no surprise homeowners will save significantly. Rent is especially high in Boston, which has the No. 5 most expensive median rent prices for a one-bedroom, according to the June 2018 Zumper National Rent Report. On average, homeowners save $586 a month compared with renters in the state.

Rising Rent: You'll Spend Millions on Rent by Age 60 in These Cities, Study Says

Buying vs. Renting a Home in Michigan

Monthly rent in Michigan: $1,150

Monthly mortgage in Michigan: $893

Should you rent or buy: Buy

Michigan has the fourth-lowest monthly mortgage payments in the country. So although the state is tied with Kentucky for the eighth-lowest average monthly rent in the U.S., it's still cheaper to buy a home there. Monthly mortgage payments are $257 less than monthly rent on average in the Midwest state. Up until a few years ago, real estate prices in Michigan took a downward turn, but property values have been rising sharply over the past year, The Center for Michigan reported.

Buying vs. Renting a Home in Minnesota

Monthly rent in Minnesota: $1,550

Monthly mortgage in Minnesota: $1,287

Should you rent or buy: Buy

In Minnesota, homeowners typically save $263 a month compared with renters. The cost difference has increased since 2017, when it was $175 a month cheaper to pay for a mortgage than to rent. People looking to buy should act fast — a low inventory has led to rising sales prices and decreasing sale times, especially in the Twin Cities, MPR News reported.

Watch Out for These: 4 Crucial Signs You Shouldn't Buy a Home

Buying vs. Renting a Home in Mississippi

Monthly rent in Mississippi: $1,125

Monthly mortgage in Mississippi: $906

Should you rent or buy: Buy

Mississippi has the seventh-lowest average rent of all the states, but monthly mortgages cost even less. On average, homeowners save $219 a month compared with renters. Mississippi has the ninth-lowest average monthly mortgage of all the states.

Buying vs. Renting a Home in Missouri

Monthly rent in Missouri: $985

Monthly mortgage in Missouri: $898

Should you rent or buy: Either

Although Missouri has the cheapest average monthly rent of all the states, it's still cheaper to buy a home there — but only by $87 a month. Rent is relatively affordable in Missouri, but it might still be too expensive for low wage-earners in the state. According to a 2018 report released by the National Low Income Housing Coalition, someone earning the minimum wage would have to work 62 hours a week to afford a modest one-bedroom rental home in Missouri.

Know Where to Buy Real Estate: Best and Worst States for First-Time Homebuyers

Buying vs. Renting a Home in Nebraska

- Monthly rent in Nebraska: $1,275

- Monthly mortgage in Nebraska: $1,034

- Should you rent or buy: Buy

Nebraska is tied with Louisiana for the 10th-lowest rent, but it's homeowners who get the better deal in the state. On average, a monthly mortgage costs $241 less than monthly rent. However, it might be difficult to find an available home in Nebraska. Only two places — California and Washington, D.C. — have a tighter housing inventory, Zillow Research reported.

Buying vs. Renting a Home in New Jersey

Monthly rent in New Jersey: $1,925

Monthly mortgage in New Jersey: $1,488

Should you rent or buy: Buy

Rents in New Jersey are among the highest in the U.S., so it's a much better financial decision to buy. Not only is it cheaper to own, but the state also boasts the lowest average mortgage rate in the country: 4.36 percent. Homeowners save an average of $437 a month compared with renters.

Buying vs. Renting a Home in New Mexico

Monthly rent in New Mexico: $1,200

Monthly mortgage in New Mexico: $1,081

Should you rent or buy: Buy

New Mexico is tied with Montana and Wisconsin for the ninth-cheapest average rent in the U.S., but it's still $119 a month less to own a home there, on average. Perhaps because of its affordable housing, home sales have been on the rise over the past year in the state. In fact, sales increased 28 percent between May 2017 and May 2018, according to the Realtors Association of New Mexico.

Buying vs. Renting a Home in New York

Monthly rent in New York: $3,300

Monthly mortgage in New York: $1,829

Should you rent or buy: Buy

New York has the highest rent in the country so it's a much better financial decision to buy a home there. On average, homeowners in the state save a whopping $1,471 a month compared with renters. That adds up to $17,652 in savings in a year.

See Where New York Ranks: From Alabama to Wyoming — The Cost of Living Across America

Buying vs. Renting a Home in North Dakota

Monthly rent in North Dakota: $1,350

Monthly mortgage in North Dakota: $1,160

Should you rent or buy: Buy

Homeowners save an average of $190 a month compared with renters in North Dakota. Neither rent nor mortgage costs have changed significantly in the state from the previous year, though home prices are actually falling in some areas, such as Bismarck, Realtor.com reported.

Buying vs. Renting a Home in Ohio

Monthly rent in Ohio: $1,100

Monthly mortgage in Ohio: $804

Should you rent or buy: Buy

Ohio is tied with Indiana, Kansas and South Dakota for the sixth-cheapest average rent in the U.S., but it's still more expensive to rent than to own in the Buckeye State, which has the second-lowest average monthly mortgage costs. Ohio is even home to some cities where you can own a home for less than $1,000 a month, a separate GOBankingRates study found. On average, homeowners in the state save $296 per month compared with renters.

Buying vs. Renting a Home in Oklahoma

Monthly rent in Oklahoma: $1,025

Monthly mortgage in Oklahoma: $900

Should you rent or buy: Buy

It's $125 cheaper to buy than to rent in Oklahoma, but either way, housing is affordable. The state has the eighth-lowest average mortgage payments and the third-lowest average rent — though rent is rising, especially in Oklahoma City, News OK reported.

Learn: How to Save for a House While Renting

Buying vs. Renting a Home in Pennsylvania

Monthly rent in Pennsylvania: $1,375

Monthly mortgage in Pennsylvania: $1,007

Should you rent or buy: Buy

Renters in Pennsylvania pay $368 more per month, on average, compared with homeowners in the state. The cost difference between renting and owning in Pennsylvania has increased since 2017, when the difference was $234. That means it's becoming increasingly difficult for minimum wage earners to afford rent in the state. According to the National Low Income Housing Coalition's "Out of Reach" 2018 report, a person who makes minimum wage would need to work 87 hours a week to afford a modest one-bedroom rental home.

Move Here: Cities Where You Can Realistically Live on Minimum Wage

Buying vs. Renting a Home in Rhode Island

Monthly rent in Rhode Island: $2,100

Monthly mortgage in Rhode Island: $1,444

Should you rent or buy: Buy

Homeowners in Rhode Island save $656 a month compared with renters. Rent in Rhode Island is the fifth-highest of all the states, which is bad news for the 40 percent of Rhode Islanders who rent their homes.

Learn: How to Decide Whether to Buy or Build a House

Buying vs. Renting a Home in South Carolina

Monthly rent in South Carolina: $1,395

Monthly mortgage in South Carolina: $1,210

Should you rent or buy: Buy

The median home list price in South Carolina is $247,913, and homeowners in the state pay $185 less per month on average compared with renters there. But South Carolina is one of the top five states that take the most out of a paycheck with a $50,000 salary.

Buying vs. Renting a Home in Tennessee

Monthly rent in Tennessee: $1,300

Monthly mortgage in Tennessee: $1,156

Should you rent or buy: Buy

Homeowners save an average of $144 a month compared with renters in Tennessee. And buying a home is a worthy investment in the Southern state — it's one of the best states for house flipping, a separate GOBankingRates study found.

Buying vs. Renting a Home in Texas

Monthly rent in Texas: $1,525

Monthly mortgage in Texas: $1,340

Should you rent or buy: Buy

The median home list price in Texas is $276,990, and homeowners in the Southern state typically spend $185 less a month on housing costs than renters do. Texas is home to two of the highest-growth real estate markets of 2018 — Austin and Houston — according to Roofstock.

Do You Make Enough? This Is the Salary You Need to Afford the Average Home in Your State

Buying vs. Renting a Home in Vermont

Monthly rent in Vermont: $1,612

Monthly mortgage in Vermont: $1,233

Should you rent or buy: Buy

The cost difference between buying and renting a home in Vermont is fairly large. On average, homeowners save $379 a month.

If you're planning on moving to Vermont — whether you want to rent or own — you could benefit from the state's upcoming Remote Worker Grant Program, which pays new residents who work for an out-of-state employer up to $10,000 to cover moving and other costs. The program is aiming to increase Vermont's falling population.

Buying vs. Renting a Home in Virginia

Monthly rent in Virginia: $1,650

Monthly mortgage in Virginia: $1,490

Should you rent or buy: Buy

Homebuyers save an average of $160 a month — or $1,920 a year — compared with renters in Virginia. That's a large jump in cost difference from 2017, when the difference was only $19.

Understand: Why It Costs $1,204 a Month to Maintain the Average Home

Buying vs. Renting a Home in Washington

Monthly rent in Washington: $1,995

Monthly mortgage in Washington: $1,729

Should you rent or buy: Buy

Washington has the sixth-most expensive average rent in the U.S., and although monthly mortgage payments in the state are the eighth-highest, homeowners still save an average of $203 a month on housing costs. Rent is especially high in Seattle, which has the No. 8 highest median rent for a one-bedroom in the country, according to the June 2018 Zumper National Rent Report.

Buying vs. Renting a Home in West Virginia

Monthly rent in West Virginia: $1,000

Monthly mortgage in West Virginia: $778

Should you rent or buy: Buy

West Virginia is tied with Alabama for the second-cheapest average rent, but monthly mortgages are even cheaper — the state has the lowest monthly mortgages in the U.S. And, the state has the lowest average mortgage rate: 4.36 percent. Homeowners in West Virginia save an average of $222 per month compared with renters.

Buying vs. Renting a Home in Wisconsin

Monthly rent in Wisconsin: $1,200

Monthly mortgage in Wisconsin: $1,019

Should you rent or buy: Buy

Rent is low in Wisconsin — the ninth-lowest of all the states — but mortgage costs are even lower. On average, homeowners save $181 per month compared with renters. However, a limited housing supply is driving real estate prices up in the state, according to a May 2018 report from the Wisconsin Realtors Association.

Now Take the Quiz: Is Renting or Buying the Right Move for You?

How Much It Costs to Rent vs. Buy Across America

Renting has become more expensive in many states since the 2017 study, and for understandable reasons. The supply of available homes to buy is very low across the country, but demand has continued to grow — a combination that has caused home prices to rise. Because people are unable to buy homes — due to paucity rather than affordability in many cases — they are continuing to rent for longer, which in turn drives rent prices up. In many states, rents are rising at a higher rate than home values, which has made it cheaper to buy than to rent in most states.

The only places where it is cheaper to rent than to buy are: Colorado, District of Columbia, Hawaii, Idaho, Montana, Nevada, Oregon, South Dakota, Utah and Wyoming.

Now, click through to see how much you'll spend on rent in your lifetime.

More on Investing and Real Estate

- The Biggest Homes for Sale Across America

- Craziest Things That Kill Your Home's Value

- 12 Essential Money Tips for Every Phase of Your Financial Life

Methodology: Rent prices were sourced from Zillow's March 2018 data. GOBankingRates used the median rent list price of all homes in each state and Washington, D.C., for this study. Monthly mortgage payments are based on Zillow data from April 2018; GOBankingRates used the median list price of all homes in each state and Washington, D.C., for this study. Mortgage payments were calculated using Zillow's mortgage calculator and assume a 20 percent down payment with a 30-year fixed loan.

About the Author

How Much Does It Cost to Rent a Jumping Castle

Source: https://www.gobankingrates.com/investing/real-estate/cost-of-renting-vs-owning-home-every-state/

0 Response to "How Much Does It Cost to Rent a Jumping Castle"

Post a Comment